Welp, we finally called it: After six months in a row of spending more than we brought in, Mr. Vega got a part-time at our favorite grocery store. That few hundred dollars a month goes a long way, and his employee discount has also helped to lower our grocery expenses. Most importantly, he loves his job, his co-workers and customers, and even after spending 8 hours on his feet, he comes home happy and energized. What a far cry from his previous career in high-pressure sales, which caused him constant stress and anxiety!

I think that what we were really trying to do should have been called “Can Two Live as Cheaply as One Under-Earner?” because the significant pay-cut that I took in order to work a “full-time with benefits” job sure didn’t help the situation any! What we’re doing now could be categorized as “Two can Live as Cheaply as One and a Half,” which seems appropriate to our Post-Recession 21st Century economic climate.

Over the past several months, there were some radical changes in my previous employer’s company culture. I tried my best to adapt, becoming increasingly uncomfortable as the changes mounted. But with Mr. Vega in school full time (and doing very well, I might add!), the pressure of being the sole earner in our household had me feeling somewhat trapped. And I was reluctant to leave the group of truly remarkable people I worked with each day… It’s no exaggeration to say that I’ve made some friendships there that will be lifelong.

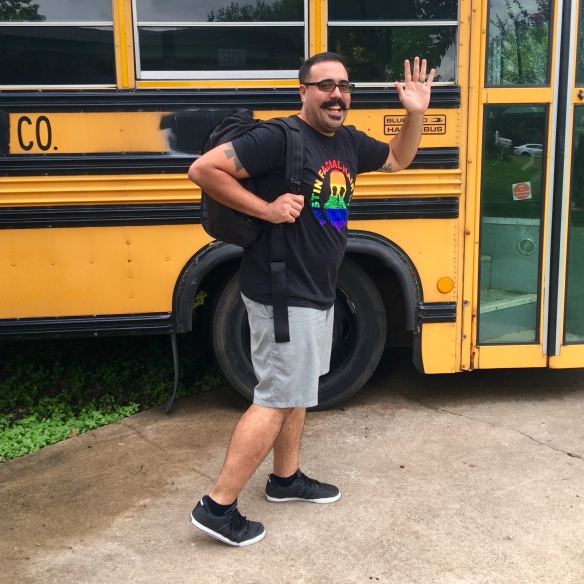

First Day of School!

Eventually, though, I came to accept that working where I felt that I was being treated unfairly was taking too great a toll on my health and relationships. On the day I tendered my resignation, so did my direct supervisor and about 1/4 of my colleagues! I’m not wishing the company any ill will, but it was validating to see so many people make the same decision I did. That was a rough week at our little hippie house, made rougher still by the reality that I had just walked away from our only steady income and our health insurance.

We went to www.healthcare.gov and selected a gold-level plan that would be accepted by most of our preferred providers, and that would give us an amount of coverage we felt comfortable with. It isn’t cheap, but it is something we believe to be more important than many other expenditures that we consider optional.

Throughout my career, whenever I have taken the leap of faith to leave an unhealthy job that I thought I “needed,” luck has been on my side, employment-wise, and this time was no exception: Two of my part-time jobs suddenly had a greater need for my services, and I was all too happy to oblige. One of them also instituted an across-the-board pay raise, the first in eight years. Those two jobs gave me enough work for the Fall that I didn’t have to look anywhere else. Because the work is at colleges, and employment during school breaks can be scarce in my field, we revived our practice of re-distributing that income by putting 1/3 of each school check into a “Summer Fund.” While that makes for a little less spending money now, it also means that we won’t be scrambling to pay the bills later.

While your mileage may vary, our takeaway lessons from our year of living on a single (reduced) income are these:

- The Emergency Fund is Everything: although we were able to manage on one income during “normal months,” the unexpected expenses would have sent us deeply into debt if we hadn’t had any savings. Fortunately, all that saving we had done in the past kept us afloat when things got difficult, and we are now able to add to and rebuild the fund.

- “Normal” Months are Pretty Rare: One month it was a tax bill that we hadn’t forecasted accurately, another was an large medical co-pay, and then there were car repairs and home repairs to be made. As one of my favorite old radio commercials used to say “Expect the Unexpected.”

- Equitable Division of Labor Keeps us Healthier and Happier: While Mr. Vega was very willing to take on all of the housework duties, and I was very willing to shoulder all of the responsibility for earning money, dividing things up that way made us miserable! He is an extrovert who thrives on human contact, so that much time at home wasn’t good for him. Conversely, I am more introverted and truly enjoy homemaking, and being gone for so long each day left me too little time to enjoy the home we worked so hard to buy. Our current arrangement allows him more time around people, and gives me more time at home, making us each much happier with how our days are spent.

- Be Willing to Seek Help: My husband has a diagnosed learning disability that qualifies him for assistance with his post-secondary education through our state’s department of Vocational Rehabilitation. When we made the decision for him to return to school and pursue a different career, we knew we could afford tuition, but we didn’t anticipate just how much his textbooks and welding equipment would cost. His willingness to explore the support available to him is allowing us to remain debt-free while he completes his degree. And because Texas is in desperate need of welders, they are happy to support his training in the field, making it a truly win-win situation.

- Work Where you Spend, if you Can: Taking on a grocery store job saves us not only a small percentage on our grocery bill, but also an hour or two each week by eliminating that errand from our schedule. Two birds, one stone!

- Underearning is as Stressful as Overspending: We are strong proponents of living as far below your means as possible. We avoid car payments by driving used, sub-compact cars, keep our computers and smartphones for as long as there is software available to support them, our house is half a century older and 1/3 the size of the average American home, and we have never taken a trip that wasn’t to visit family. We know that many people don’t have the option to seek higher-paying work, and are already working more hours than they should have to in order to make ends meet, and we are grateful to have the opportunities we do. And there are a few things like craft beer, high-quality shoes and occasional nights out that, while they are absolutely possible to live without, make us happier when we have them. So we’re willing to work a little more in order to keep those luxuries.

There are so many factors that go into deciding how a household operates best, and we are lucky to be able to experiment with different ways of doing things. It’s been a challenging year, but also an invaluable experience in learning more about ourselves and about what constitutes balance in our particular situation.

What lifestyle changes have you tried making? How did they work for you?