I first read about grocery price books over at The Simple Dollar, years ago. Not being into spreadsheets… or math… or shopping, it didn’t seem to me to be a terribly sexy project. The other ways in which I managed to trim my expenses were successful enough that I usually had enough room in my food budget to buy whatever I wanted whenever I wanted without much thought. When Mr. Vega and I began to focus more on whole, real, organic foods, our grocery bills went up, and I just felt happy that we could afford to eat the way we wanted to. After all, we were debt-free, saving for a house, and even had money left over for travel and fun.

Since my husband traded his full-time sales job for life as a full-time student, however, we’ve had to tighten our belts a bit. In January, we managed to wrestle our food expenses down to just over half of what we’re accustomed to spending… mostly by eating out much less than we had been. Also, one of my favorite bloggers, Brandy over at The Prudent Homemaker, is diligent with her food expenses: She keeps a detailed price list of food she buys to feed her family of nine, and her monthly shopping lists are terrific guides to seasonal low grocery prices. Simply following along and stocking up on some things when she does has been tremendously helpful!

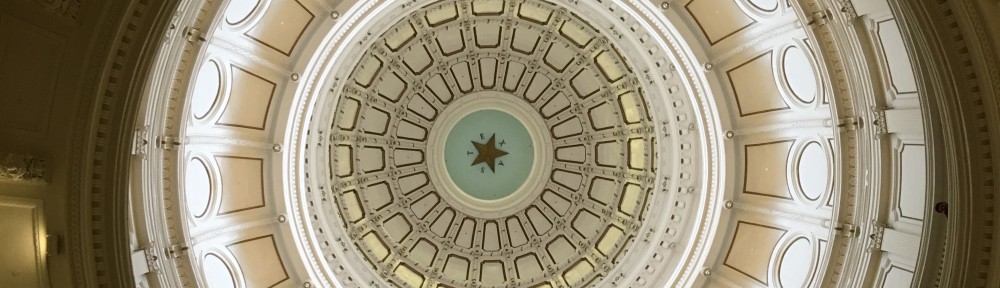

But each home is different, and no one solution works for everyone. Our household in Austin, Texas, comprised of two adults with full-time outside commitments, two cats, and a nascent garden, is quite different from hers in Las Vegas with seven children, a work-at-home spouse in addition to a full-time work-outside one, and an abundant home garden that is the result of several years’ worth of effort. And both her home and mine will be different from yours, with your brand-new baby, or giant dogs, or busy travel schedule.

And so the time has come for me to buckle down and invest a bit of time and energy into learning exactly what our most-purchased items usually cost, what a good deal really looks like (because fifty cents off sounds great, but what if it’s normally sixty cents cheaper at the store down the street?), and seeing how much more space we can get in this recently-contracted budget of ours.

I’ve sorted through our shopping lists, and created a spreadsheet on Google Drive listing sixty items we purchase regularly (conventional wisdom suggests starting with a list of 15-20 things, but once I started, I kept thinking of more!), and I’m actually looking forward to learning where the best prices are and seeing how much money we can save. Grocery store sales generally run in 8-12 week cycles, so I reckon it will be Spring by the time I have a good handle on this, but check back and I’ll share how it’s going!

How do you keep track of grocery prices in your area? What patterns have you noticed?