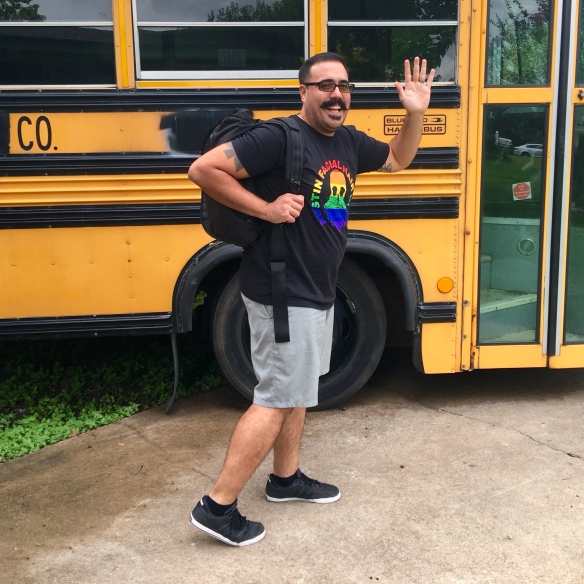

After several years of inactivity and weight gain, I am Ready to Exercise!

People who struggle with their weight, or who experience psychological or emotional imbalances that interfere with consistent self-care and fitness have probably been here many times: After a period of inactivity, we find ourselves ready and even excited to return to a fitness regimen. We generally also find ourselves with a body that is much less fit and possibly much, much larger than it was the last time we were in an exercise groove. Calling that “discouraging” is an understatement at best.

If you are friends with someone like me, and if you are reasonably fit and your schedule aligns with ours, you may at some point receive a request to exercise with us. We want accountability, companionship, and encouragement to do this thing we’ve probably done or attempted many times before: Getting in Shape. In the past, we may have run marathons, biked across Europe, or hiked to Machu Picchu. We may have played sports for many years, or been dancers when we were younger. But whatever our previous achievements, we now find ourselves at the beginning, and needing support. And if we’re feeling very brave, we may even ask for it.

I recently reached out to a friend who, although I enjoy her company immensely, became my workout partner mostly by virtue of having a schedule similar to mine and belonging to the same gym I do. After a few workouts together, I have realized that she’s the absolute model of everything I have ever needed in a workout partner when I am doing the difficult work of Getting in Shape. I feel so very lucky to have her in my life and especially to have her at the gym with me!

I want to share what she does that I find so helpful, so that any of you reading who find yourselves in her position might be able to better navigate it, or so that anyone currently standing in my XL active wear might get some ideas about how to recognize and ask for what they need to be successful.

To begin with, She’s Flexible About Time. My friend schedules enough time at the gym to allow me to do a longer, slower workout, or to finish a workout that began later than expected. She understands the massive psychological resistance I have to work through just to get there, and so if I’m running late, she simply hops onto a cardio machine and greets me cheerfully when I arrive. Unlike working with a personal trainer, a late start with my friend doesn’t have to mean a shorter workout. She understands that what may be a 45-60 minute experience for an already-fit person could take me up to 90 minutes, and she never rushes me.

Something else she does that is incredibly healing and esteem-building for me is that She Lets Me Lead our Workouts. I’ve exercised with many people, some of whom were professional trainers, who mistakenly equate my being fat or out of shape with an ignorance of how to exercise. But my workout partner understands that I have experienced both Being Fit and Getting Back in Shape many times, and she respects my knowledge of fitness and exercise. She may do higher-intensity activities in between our sets, or get on the stair-climbing machine next to my treadmill during cardio, but she’s also genuinely happy to let me do the workout I already know my body needs, and is even excited about learning from me! Unless you’ve done it, I don’t think you can imagine how intensely validating it is to be the fat one at the gym helping your fit friend with her form and breathing! She even texted me the day after our first workout to say that she was sore in new places, and thanked me for getting her out of her fitness rut! I honestly feel that she’s benefitting from this arrangement as much as I am, rather than holding herself back to let me catch up, and it’s wonderful for me to feel valued for what I have to offer.

In our conversations at the gym, I’ve also observed that She Doesn’t Tell Me How to Think About Myself. She winces a little every now and then when I use the word “fat,” but she doesn’t do that whole “You’re not fat!” thing that women often do to each other. Telling someone what they just said about their experience isn’t true is not a compliment, it’s projection at best and gas lighting at worst. With a BMI of 30.4, I’m straddling the line between “Overweight” and “Obese,” and pretending otherwise is neither helpful nor flattering. When I mention my weight, or the difficulty it’s causing me, she listens and sometimes asks questions, but she doesn’t try to assuage her own discomfort by telling me that my experience or my feelings about it are wrong. What she did say today when I was talking about my flabby arms was, “Well, your tattoos are way too beautiful to cover up, so I’m glad you’re willing to show them off!” Now that’s a compliment!

Finally, and this may seem like a small thing but it can make the difference between success and failure for someone in my position, She Schedules our Next Workout Before She Leaves. She and I have dynamic work/life schedules, and so we can’t simply decide to exercise every Monday, Wednesday, and Friday before or after work like many people can. Before we say “goodbye” for the day, we get out our calendars and choose the next time to meet, typically within 2-3 days. If we need to change it later, we can, but having the next workout agreed to and scheduled eliminates the potential barrier for me of having to contact her and go through several rounds of phone- or text-tag to make plans to exercise again. At this stage of my fitness, where everything still feels unduly challenging, it would be all too easy to give in to the temptation of letting it slide for a few days, and then a week or a month, and eventually giving up altogether. The simple act of taking a moment to put it in our calendars removes that temptation and keeps me on track.

Everything my friend does to make me feel excited about going to exercise with her, I think she does intuitively, without even realizing how deeply she’s helping me heal from the issues that prevented me from maintaining my good health and fitness in the first place. She happens to be genuinely patient and accepting on a level that few of us (myself included) ever master without a great deal of inner work and practice. But everything she is doing is also relatively simple to put into practice with just a little self-awareness and effort. For your friend who is fighting their way back to being healthy after an extended period away from exercise, your ability to show up just a little differently for them could be the very thing that gets them through this critical “beginning-again” period and back into a life of comfort and ease in their bodies and in the world.

And that would probably make you both feel fantastic about yourselves.