Stretching a dollar!

This past Summer, I realized that the full-time job I had taken on was not a good fit for me. I called my husband and explained my feelings, and he responded “Then quit! We’ll be fine, we always have.” The next morning, I tendered my resignation.

A couple of months later, A Random Thing happened at one of my several jobs, and work hours were cut in a way that affected some people (myself included) more than others. It’s been humbling to hear people speak about the problems that the drop in income is causing. Because while the change has tightened our finances, it did not constitute a financial emergency in our home, the way it has with some of the others.

Shortly after that, Mr. Vega reached his personal stress limit at his place of employment– in fact, with his entire field of employment– and we were able to make a plan for his career change that allowed him to leave his job within a couple of weeks. He is registered and ready to return to school in January, for a two-year program to train for an entirely different career.

Most recently, a family friend lost a close relative, and Mr. Vega was able to get on a plane with a week’s notice to attend the funeral in another state. Spending time with his friend of more than twenty years, and with his friend’s extended family of origin, gave him insights he would have never gotten otherwise. Not only was he able to support a dear friend during a sad time, but their connection was enriched simply because he could be present.

Although it’s actually a lot more fun that most people might imagine, living beneath our means isn’t always easy. Mr. Vega wore the same three pair of dress pants for work until they literally wore out. I finally replaced the last pair of work appropriate flat shoes I owned… about six months later than I should have. We have eaten beans and rice and potatoes and leftovers cooked more ways than I previously thought possible. We drive subcompact cars when we would prefer SUV’s and classic trucks. We bought a house with one fewer bedroom, one fewer bathroom, and one less garage space than we would have liked, because it was important to us to keep our payments well below what we could afford. Those are all choices we have made so that we could pay off our debt, save an emergency fund, and buy our own home.

Spending less when you have the ability to spend more feels, in some ways, more challenging than being flat broke. Because the money is there, after all, and there are days when it feels like everyone we know has more than we do. They drive newer, nicer cars, eat out in fancy restaurants, wear more fashionable clothes, live in bigger houses, and take actual vacations to exotic locations where they aren’t even visiting relatives! Most people assume from our spending habits that we’re broke, and those who know better wonder why don’t just “treat yo’self” the way they do. On top of that, we see tens of thousands of advertisements a day, all of them telling us that life will be better, we will be more attractive, and that we will feel more successful if we just buy their service or product.

That all starts to look pretty darn tempting, until we realize the true cost. In 2013, CNN Money reported that 76% of Americans are living paycheck-to-paycheck, and earlier this year, Deutche Bank published findings that 47% of American households have nothing saved for an emergency. Which means that for the vast majority of people living in my country, a job loss, an illness, or even a cut in hours could throw them into bankruptcy, or worse: The National Alliance to End Homelessness reports that more than half a million Americans are currently homeless, and nearly 8 million of us (including members of our own family) are living doubled up with family or friends, representing a 67% increase in doubled-up living since 2007. Another 6.4 million of us are spending more than half of our monthly income just on housing. That’s not living, that’s survival.

We still go out, spend money, and have fun… we just make sure that when we do, we’re spending less than we could potentially afford. Last night, we picked up some good friends in our little paid-for car, went downtown for a few $4 Happy Hour cocktails, and then took a walk to view a free, outdoor art exhibit. We spent hours talking about everything that was on our minds, encouraging each other in taking steps to achieve our goals, and having a really, really good time. At the end of the night, we went back to their modest apartment, talked some more, and rolled around on the floor with their affectionate, happy (and rescued!) dogs for about an hour. You can’t buy that type of contentment.

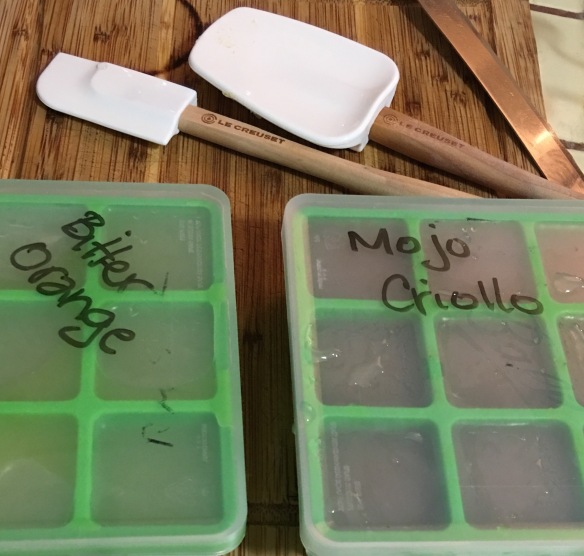

This morning, we made a breakfast hash of leftover coffee-rubbed pork and– you guessed it– potatoes, that was as delicious as any $12-a-plate restaurant meal, and we’re looking forward to taking in a movie tonight at Alamo Drafthouse with some new friends. Although the food at the theater is very good, we’ll probably have dinner at home first and then just get some drinks and snacks at the movie, and our good time won’t be lessened because of it.

Because when Life Happens, and it always does, we don’t want to have to stay in jobs that make us miserable, or go into debt to make our bills, or miss out on showing up for the major life events of the people we love… or lose our home. Choosing to live beneath our means allows us to retain control of a lot of other decisions in our lives. Decisions that would be made for us if we lived paycheck-to-paycheck and an emergency arose.

Can you find one thing you can spend less on than you have been, no matter how small? I’d love to hear about it in the comments.